Grantham's AI Bubble Call: Genius or Just Another Doomsayer?

Grantham's AI Bubble: Chicken Little or Cassandra?

Grantham's AI Bubble Warning GMO's Jeremy Grantham is once again raising the alarm about a potential bubble, this time in the AI sector. It's a familiar tune from a man who's been warning about market excesses for years. But is this just Grantham being Grantham – the perpetual pessimist – or is there real substance to his claims this time around?AI Stock Mania: Reality or Just Rampant Speculation?

Valuations and Speculation in AI Stocks Grantham's firm, GMO, points to "very high valuations and signs of rampant speculation" in AI-related stocks. They highlight quantum computing stocks, claiming some have seen increases of "1200% or more over the past year." That's the kind of number that makes any rational analyst raise an eyebrow. While a 1200% gain is eye-catching, it's crucial to understand the starting point. Were these penny stocks trading at fractions of a cent, making them susceptible to dramatic percentage swings? Or were they established companies with solid fundamentals? The article doesn't specify, and that lack of precision is a red flag.AI's Dot-Com Echo: Hype vs. Reality?

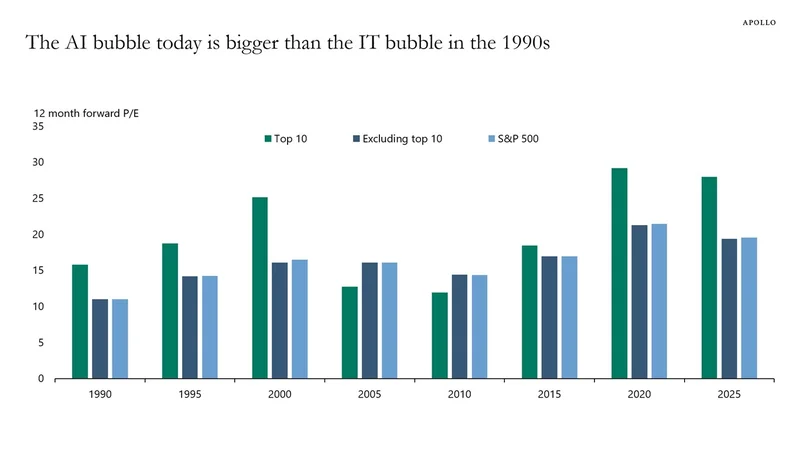

Parallels to the Dot-Com Bubble GMO draws parallels to the dot-com bubble, suggesting that while AI is a real and transformative technology, the market's enthusiasm has become detached from reality. This is a compelling analogy. The late 90s saw a similar rush to invest in anything with a ".com" suffix, regardless of its actual business model or profitability. Many of those companies flamed out spectacularly, leaving investors with nothing.S&P 500: Magnificent Seven or Market Mirage?

The "Magnificent Seven" and the Illusion of Broad Market Gains Grantham notes that much of the market's gains have been concentrated in a handful of mega-cap tech stocks – the "Magnificent Seven." He argues that the broader market actually drifted lower for much of 2023, with these few companies accounting for almost all of the gains. This is where the analysis gets interesting. The S&P 500 is a market-cap weighted index, meaning that the largest companies have a disproportionate impact on its overall performance. If a few mega-caps are soaring while the rest of the index stagnates, the headline numbers can be misleading.Magnificent Seven: Hype or Hyper-Growth?

Are the "Magnificent Seven" Justified? The question then becomes: are these "Magnificent Seven" genuinely different? Are their AI-driven prospects so bright that they justify their outsized valuations, or are they simply benefiting from a market-wide mania? It's tough to say definitively. Companies like Nvidia, for example, are undeniably benefiting from the surge in demand for AI chips. But even Nvidia's valuation – trading at a hefty premium to its historical averages – seems to bake in a lot of future growth.Value Investing: A Safe Haven From the AI Storm?

Alternative Investment Opportunities GMO suggests that investors worried about an AI bubble can find opportunities in developed market value stocks and non-US small-cap value stocks, particularly in Japan. This is a classic value investing strategy: look for companies that are trading at a discount to their intrinsic value, often in sectors or regions that are out of favor. The Avantis International Small Cap Value ETF (AVDV) and the iShares MSCI Intl Value Factor ETF (IVLU) are mentioned as examples of funds offering exposure to these trades. While these ETFs might offer diversification, their performance will ultimately depend on the underlying performance of the value stocks they hold.Relative Value: A Dangerous Game of "Ifs"

The Focus on Relative Value I've looked at hundreds of these "bubble call" reports, and the common thread is always a focus on relative value. *If* AI is overpriced, *then* these other assets *must* be cheap. But that logic only holds if you believe that capital will actually rotate out of AI and into these other sectors. And that's not a given. Markets can remain irrational for extended periods, and investors can continue to pile into the same crowded trades, regardless of valuation.Grantham's AI Call: Genius or Just Lucky This Time?

So, Is Grantham Right? Grantham's track record is a mixed bag. He correctly predicted the dot-com bust and the 2008 financial crisis, but he's also been early – and wrong – on numerous other occasions. The key takeaway here isn't whether Grantham is right or wrong *this time*. It's about understanding the risks and rewards of investing in a sector that's clearly experiencing a lot of hype. According to GMO, AI is a "Classic Investment Bubble", and they suggest alternative investments.AI's Uncertain Future: Hype vs. Reality

The Uncertainty of AI's Potential The fact remains that AI is a nascent technology with enormous potential, but also a lot of uncertainty. The companies that will ultimately succeed are far from certain, and even the winners may not justify their current valuations. Investors who are chasing quick profits in AI stocks should be aware that they're playing a high-stakes game. And as Grantham points out, there may be more attractive opportunities elsewhere in the market for those who are willing to look.Déjà Vu All Over Again?

Is It Really "Different This Time?"